For an online seller or a freelancer, either a seller of goods or services, the biggest problem is how to get your customer’s payment. But there are a number of options you can use. Bank deposit and money transfers are among the popular choices here in the Philippines but what if your clients or customers are from abroad? It will be costly to use the above mentioned but there a payment method that is very popular worldwide and that is PayPal. Good thing is, that Filipinos can now use Paypal for online transactions and you can receive money from clients by using your email address. And you can transfer your money from Paypal to your own bank account by just using the withdrawal feature in Paypal’s account interface. But the problem you will encounter even if you have a bank account is you should also have a credit card.

And what if you are self-employed online entrepreneur? you will have a hard time getting approved because most of the time those who are employed with stable income or have big sums of money in their bank account can have a credit card. If you can’t show a proof of income or the bank officer thinks that you don’t have the capacity to pay, then they won’t hesitate to reject your application. You will also not be able to use all the features in Paypal like the withdrawal feature if you don’t have a credit card because it’s the only way for you to verify your paypal account. So the only way is to get a credit card alternative and that is a debit card. There are many advantages of using a debit card compared to a credit card. For one thing, you will not incur debts and exorbitant interests. The yearly membership fee is also a fraction compared to a credit card. You can also use the debit card to save and withdraw your money like an ATM card.

And last but not the least, I want to share you this quote – “A banker is a fellow who lends you his umbrella when the sun is shining, but wants it back the minute it begins to rain.” So now you know why banks do the best they can to collect your credit card payment when you aren’t able to pay anymore.

There are a number of debit cards available in the Philippines that you can use on your paypal account. Here are some of them:

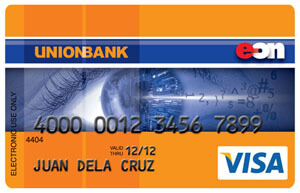

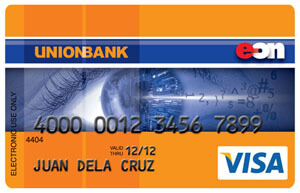

1. Unionbank EON VISA Debit Card – This debit card as far as I know is the first debit card introduced in the Philippines that can be used on international purchases online and works specially for Paypal. The annual membership fee as of today is only 350 pesos. There are also rates and fees on ATM transactions which you can see on the Unionbank website. It is also easy to get one. You can apply online or go to the nearest Unionbank branch and present 2 valid photo bearing ID to get the card.

How to verify your Paypal using your Unionbank EON debit card:

- Enroll your EON debit card on the Unionbank cyber account online banking.

- Make sure you account has at least Php100 or more. But it is advisable to have Php200 or $3. Don’t worry, paypal will deduct the Php100 for verification only and it will be refunded to you after the verification process.

- Then add your EON debit card to your paypal account. The process is similar to a credit card since they both have an account number and 3 digit CVC at the back. Input those information and click the verify link to process those information.

- Go to your EON cyber account online banking service and log-in. Look for the 4 digit expanded use number or EXPUSE in your transaction inquiries. The EXPUSE according to Unionbank will appear in your account within 5 banking days but in my experience it only took within 3 days.

- Use the EXPUSE number to verify your EON card in the box provided in your paypal account. Just find the verify link to go there.

By the way, you can also link your EON debit card as a bank account. But don’t use the 16 digit card number printed on front of the card. There is a 12 digit bank account number aside from the 16 digit card number. The 12 digit bank account number of EON can also be found on the front of the card just below the 16 digit number printed in smaller font size. It is easier to link your debit card in paypal as a bank account because you don’t need to wait for the EXPUSE to verify your card. After linking it as a bank account, you are ready to transfer your paypal funds. One of the advantages of linking it as a bank account is the cheaper transfer fee compared to credit card or debit card. But the only drawback is you can’t purchase online unlike a debit card.

2. BPI My ePrepaid MasterCard – similar to BPI cash card, this debit card is designed to allow you to securely and conveniently shop in all MasterCard affiliates online and worldwide. Yes it can also be used to verify in Paypal like a credit card. The registration fee is only Php500 and it is renewable every two years. You only need 2 valid IDs and submit the filled up registration form to apply for a BPI My eprepaid card.

How to verify your Paypal using your BPI My ePrepaid MasterCard:

- Â Deposit or transfer funds not less than Php100 that will be used later for Paypal verification process. If you have a BPI savings or checking account, you can transfer the fund to your debit card via online banking using your computer or mobile phone via internet. Or you can just deposit the payment over the counter if you don’t have a BPI bank account.

- Then go to your paypal account and add the 3 digit CVC code (which is usually found at the back of the card) on your paypal account. Then click the verify link to process the information.

- Then email [email protected] after 2 days to request for the 4 digit EXPUSE code. You should include your name and the 16 digit debit card number in your email to avoid delays.

- No need to email them if you enrolled your BPI eprepaid debit card in your BPI express online assuming you have one. You can get the EXPUSE code on the transaction inquiries.

- Use the EXPUSE number to verify your EON card in the box provided in your paypal account. Just find the verify link to go there.

(Update as of June 16, 2014 -Â Â the Western Union Prepaid Card Program was already discontinued)

3. Western Union Prepaid Gold Card – I personally haven’t tried this one yet because I’ve already have an EON debit card. But I think this will work too because it is a debit card and has a 16 digit account number and a CVV security code just like a credit card. Those two, beside your account name of course are the basic requirement for you to verify your paypal account. You can also register your prepaid card on the Western Union website and manage or track your balance. Most probably you can also see the EXPUSE verification code on your transaction inquiry. There are also advantages using this card if you are a frequent sender or recipient of Western Union remittances because you can ask the Western Union agents to transfer your remittance to your prepaid card. Just like the 2 debit cards I mentioned above, your can withdraw your funds in any ATM in the Philippines or abroad.

(Update as of June 16, 2014 -Â Â the Western Union Prepaid Card Program was already discontinued)

(#4 RCBC MyWallet Visa Card was just added today November 21, 2016)

4. RCBC MyWallet Visa Card – If it seems that all of the above debit card I’ve mentioned is not acceptable to you or maybe you are having problems availing them because the banks are asking too much documents, then I think this debit card will solve your problem. To avail MyWallet Visa card, you just need to present a photo bearing ID and fill-up the application form and pay a purchase fee of 150 pesos for the card. You need to load an amount let’s say 100 pesos but there is a 20 pesos charge for every loading of the card (the term “loading” is applied to debit cards like this when you put your money in the card which is similar when you make a deposit to your savings account).  So to load 100 pesos you have to load 120 pesos because the 20 pesos will be automatically deducted. Yes it looks like you will spend some cash when loading the debit card but the annual fee is only 100 pesos on MyWallet compared to EON debit card which is 350 pesos. There is also no withdrawal fee when you use RCBC saving bank ATM (update: I saw on the RCBC website that there is a minimal charges of 2 pesos for withdrawal and 1 peso for balance inquiry). But other banks ATM on the megalink network have withdrawal charged of course. Just for the info, there are 2 kinds of RCBC Mywallet, one is the basic Mywallet that you can only use locally and cannot be used on paypal. The other is the Mywallet Visa card which I have been discussing above.

One good news that I want to share is that you can enroll on rcbconlinebanking.com website for online banking using the RCBC mywallet. I think last year they still don’t have an online banking for Mywallet when I availed my first debit card from them. It’s just last month that I discovered that they already have online banking for this debit card. So you can instantly see the 4 digit EXPUSE code when you verify you paypal account. The procedure of verifying your paypal account is almost the same as the UnionBank EON debit card which I’ve already explained above. You can also link it in your paypal as a bank account as I already explained above when you link the EON debit card as a bank account. But the only difference is that you can use the 16 digit debit card number as your bank account number.

There are other local debit cards available like the BDO Ko-Kard but you need a BDO credit card to get this so I think this is an overkill if you will get a prepaid card if you already have a BDO credit card. So I hope this info helped you getting verified in paypal and if ever you know other local debit card providers, please share it by posting your comments below.

By the way, I would also like to mention the withdrawal fees that paypal charges to your transaction. Below are the charges as of November 2016:

Unionbank EON:

If used as a debit card:

7,000 pesos and above = 250 pesos

6,999 pesos and below = 250 pesos + 50 pesos

If used as a bank account:

7,000 pesos and above = free

6,999 pesos and below = 50 pesos

RCBC Mywallet:

If used as a debit card:

7,000 pesos and above = 250 pesos

6,999 pesos and below = 250 pesos + 50 pesos

If used as a bank account:

7,000 pesos and above = 110 pesos (remmitance fee)

6,999 pesos and below = 110 pesos + 50 pesos

Hi po ? Pwedi po ba yung chinabank atm pag withdraw sa paypal ?

Hi Sir Manny,

Can I use my eastwest debit Card to link for my paypal accout? How to link my debit card to to my paypal account?

Hi Joseph, yes as long as it is Visa debit card. The procedure is almost the same as the debit cards in the post above.

Sir Manny, meron po akong BDO debit Cart (Master Card), pwede po ba itong gamitin para sa Paypal account?

Sir manny pahabol lang po .. ano po b mas magandang gamitin ?? Debit card or credit card sir for withdrawing money from paypal account ?? At ano din po b mas maganda sir bank accounts or debit/credit card sir ?? Sana sir mpansin nyo po ang mga katanungan ko . Maraming salamat po .

Hi Charmaine, Actually kahit may bank account ka ay kailangan mo pa rin ng debit card or credit card kasi kailangan ito para ma verify yung paypal account mo. Additional lang yung bank account pero ang advantage nya ay wala ng 250 pesos transfer fee pag mag wiwidraw ka sa paypal. Sa opinion ko lang, mas ok yung debit card. Kasi pwde mo syang gamitin na parang credit card or bank account sa paypal. Basahin mo lang ulit yung blog post for details.

Sir and2 poko sa bahrain wala poko credit card ayaw nman tangapin ng paypal un ATM debit card information ko sa paypal panu ko po malalagyan ng Pera un PAYPAL ko please help ito po email address ko po [email protected] please email me po

Hello sir manny ! First of all thank kc laking tulong nyo po specially sa aming first timer gumamit ng paypal .. sir nag may online job po ako na Paid to Click Advertise .. nag register po ako ng paypal account then hnd ko po alam kung pano at ano ang gagawin para mawithdraw po dito sa phils… nabasa ko po dito ok lang kahit walang bank account basta may debit card or credit card ..??

Hi sir Manny, i just want to ask.. I have an online page , which i used for selling bags. I just want to promote my page to gain likes and to expose my page on other facebook users. But only way to do that is to connect paypal because I need to pay on what I have provided. I just created my paypal account but I dont have any debitcard or credit card yet to verify my account. Now Im thinking to open an account from bdo. Is it possible to connect my paypal account to bdo??

Hi GLESZ, I think the only way to verify your paypal account is by credit card or debit card(visa or mastercard). You can add a BDO bank account to paypal for withdrawing funds from your paypal but you still need to add a credit card or debit card to verify you account.

Hello po, need pa ba ng bank account? Kailangan po bang naka connect kami as bank nila for example bpi, need pa po ba namin mag apply ng acc sa bpi

@Jomar, basta may visa debit card ka na, ok na yun no need for another bank account.

Please, I would like to inquire if my registration with Paypal is completed and registered.

Hello.. Ano po masmura ung rcbc or ung eon? Debit card.

Saka May mga charges din poba pag magwiwidraw ka using ur eon card at rcbc?

@Akihiro, please read the post again.

Hi po..pwede po b ang ucpb debit card pambyad s pay pal..mu gsto kac aqng ipurchase s ebay

Hi sir para ba makakuha ka ng eon debit card kailangan ba may bank account ka???

Hi Ace, hindi na kailangan ng bank account. 2 valid IDs lang kailangan at submit mo yung photocopies ng IDs mo. May form ka rin na pipirmahan at magbabayad ka ng 350 pesos annual fee.

Nung nag try ako kumuha ng eon debit card requirement daw nila proof of income kaso unemployed ako, kala ko sa credit card lang kylangan yung ganun. Same din ba requirement sa ibang banks like BPI?

tsaka pwede ba BDO cash card(debit card) para makapag open ng account sa paypal?

Hi Al, Wala naman requirement na proof of income kahit tingnan mo pa sa website nila: https://www.unionbankph.com/personal/debitcards/cards/eon/eon-faqs

Baka nagkamali lang yung kausap mo o kaya nagkamali lang kayo ng dinig. Proof of Billing ang hinihingi sa iyo in case na yung ID nyo ay iba ang address sa present address nyo. Yung tungkol naman sa BDO cash card, hindi yata pwede kasi walang visa logo.

Hi Sir Manny,

Thank you po sa blog na eto. Napakahelpful para sa isang freelancer na gaya ko. I would like to ask po sana kung saan po jan ang best option next to EON card. Naubusan daw kasi dto sa branch ng Baguio City. Almost 2 weeks na po ako nag aantay at nagchecheck kay Union Bank pero wala pa rin. Kaya hnggang ngayon, d pa mapadala ng boss ko from US ung sahod ko. Alin po jan ang may lowest transaction fee and mas mabilis kapag mag wiwithdraw ng funds?

I look forward sa suggestion niyo po. Thanks and more power!

Hi Kristine, So far ang na try ko lang na okay pangalawa sa unionbank EON ay ang RCBC MyWallet. Kaya lang may 110 pesos na additional fee on top of the other paypal charges like the 50 pesos if below 7k if linked as a bank account (if you link it as debit card there is 250 pesos charge). Pero mabilis magtransfer ng fund about 2 to 3 days lang (in my experience, di ko lang sure sa iba kung ganun din kabilis). At pwede ka rin maka access sa online banking (Mywallet) at madali lang mag register online sa RCBC access one. Yung ibang debit card gaya ng BDO debit card di ko ma register sa online banking.

Thank you sa pagreply. I’ll go for RCBC then pag wla pa rin EON by next week. Salamat po ulit 😊😊😊

You are welcome!

How can i send money using my BDO bank account ? I dont have an atm coz i lost it .

Hi Ashley, local bank accounts can only be used to withdraw your funds from paypal.

hi sir

pwede po ba malink ang bpi express teller debit card para magbayad sa paypal?

thanks

Hi Jabo, you can link your BPI express teller to paypal but it can only withdraw funds from your paypal account if you have any. But you can’t use it to purchase online. Only debit cards and credit cards can be used to purchase using paypal.

Pwd po gv kyo advice which is best among sa mga na discuss nyo regarding to connect paypal? Need q po kc un pr mkwithdraw, at sa ngayon need q din mgbayad true paypal..at in near future gusto q ndin mgjoin sa bisness online..alin po bgay na accoubt nai apply q pr isang fill up nlng na maa-acknowledge sa paypal. True ur blog ngka idea po aq ky ito un asked q na tnx sa inyong mgi2ng reply..God bless

Hi Neriza, In my experience, Union Bank EON Debit card is the best among other debit cards issued here in the Philippine. Parang made for paypal talaga yung EON. Unang una, ang bilis mag-withdraw ng funds from paypal. It usually takes 3 to 7 days on other debit cards, bank accounts or credit cards. Eon only takes 1 to 2 days. Pangalawa, walang transfer fee kapag 7k pesos above ang fund na i wi-withdraw mo (provided that if you will add EON as a bank account, not as debit card. If you will add it as a debit card, there is a 250 pesos charge). Sa RCBC may 110 pesos transfer fee kahit 7k above ang i wi-withdraw mo plus the 250 pesos charge. There is a 350 pesos annual fee for EON debit card but that is negligible for the good service.

…hello! Tnx so much..tom sundin q un advice nyo at last makakapag purchase ndin aq sa ebay..hurray! (:

More success! So approachable u.. M sure marami kyo ntulungan thru ur blog..God bless!

Hi Neriza, No problem. Thanks for visiting and sharing your comment. Just a reminder, kung gagamitin mo yung EON para mag purchase using paypal, add it as a debit card, not as bank account. Yung bank account good lang yun pang withdraw ng funds, di pwede mag purchase.

Hello, I have a BDO debit card and don’t know if this is acceptable for paypal international transactions. Any advice given will be highly appreciated.

Thanks a lot

Hi Billy, As long as your BDO debit card has a VISA or Mastercard logo and a CVV number at the back of the card (a 3 digit number on the right side of your signature) you can link it in paypal. The local BDO debit card which does not have a VISA or Mastercard logo cannot be used in paypal as a debit card but I think you can try adding it as a bank account. Use this BDO bank code: 010530667 for adding it as a bank account in paypal.

tanung ko lang dito sir, regarding sa RCBC at EON sabi mo wala charge apg nagtransfer ka? ito nabasa ko kasi ang EON is debit card din sya

“Withdrawals to a debit or credit card are charged $5.00 withdrawal fee per transaction by Paypal. For non-US dollar accounts, Paypal uses the prevailing exchange rate at that time.

For UnionBank’s EON cardholders, take note that the EON account is actually a debit card so it falls under this category and not under “Bank Accountâ€, which means the withdrawal charges are different from the fees previously mentioned.”

Hi Avi, I said, there will be no charges if you will link it in paypal as a bank account and not as debit card provided that the amount is 7k pesos or above. EON debit card pa rin yun pero gagamitin mo sya as bank account. Yung $5 withdrawal fee na sinasabi mo ay pag nai-link mo sya sa paypal as debit card.

Sir Manny, may tanong po ako regarding paypal. may pera po ako dun at gusto ko ng eencash dahil may sakit asawa ko ngayon. I tried to find you on facebook. and i already added you po doon. nahihirapan po ako kung papano ko eencash yung pera ko na andun, i have BPI family savings card. pero nag deneclined sila sa card ko when i am trying to withdraw my money there using my BPI card, sana po makausap ko kau sa facebook. para sa mas malinaw na convo. salamat po

Hi Khriss, Baka mali yung ginamit mong bank code dun sa BPI family saving bank card mo nung nag add ka nag bank account sa paypal. Take note BPI and BPI family savings bank are different banks. This is the BPI family saving bank bank code: 021000021

Delete mo ulit ung bank account mo sa paypal at add mo ulit at gamitin mo yung bank code na sinabi ko.

hi sir.. how to have a paypal account but i don’t have business.. just for receiving payment for being a brand ambassador..

Hi Annie, you don’t need a business to have a paypal account. Just go to paypal website and register. Then use your credit card or debit card to make your account verified.

Hello po Sir Manny. Are there any other options to withdraw your paypal account po even if you don’t have bank cards yet? Example po Western union without card, Moneygram, Palawan Express etc similar to that. And how long will it take to get the money po? Thank you.

Hi Ara,

Sorry as far as I know only debit cards, bank accounts (e.g. saving account) or credit cards are the only way to withdraw your money in paypal.

Hello po. Pwede ba ung sa RCBC My Wallet pero savings sya, sa pagkakaalam ko kci ang pwede lang is ung black or ung may Mercury Drug na logo. Salamat po!

Hi Mark Lester, I haven’t tried RCBC My Wallet but I think you can use the one with a Visa logo. Pagka alam no yung RCBC My Wallet is a Debit card not a saving account. Mercury drug logo? parang hindi yata pwede yan kasi kailangan international debit card.

Hi sir, ask ko lang po what to choose po sa account sa paypal if freelancer?

Kasi tried sa business but i dont know what to fill sa business name and other business slots etc.

Hi Eliza, I think you don’t need a business account since you are only using it as a freelancer. Paypal business account is for online sellers like for example an ebay seller.

hi sir manny, i dont have bank account coz i can’t applied due to lack of identification card. is it okay that my brother can apply for the eon at union bank and i will use it for my paypal account so that the money transfer to his account once he already have an eon account?

Hi Princess Anne, I’m sorry to tell you that you can only use a debit card in paypal with the same name. The name in the debit card should be exactly the same as your name in paypal. The only solution is to use your brother’s name when signing up in paypal. When you receive or send money only the email address is used so even if you use your brother’s name there is no problem with that. You can also look for other debit cards with a Visa logo. I think it is easier to get a Yazz debit card.

Hi. Good day. Can i ask something? Does paypal have a fee when i sign up? Then, i have no any bank accoounts. What shall i do. Im only a student. Thankyou. Godbless

Hi Angela Custodio, paypal does not ask for a fee when you sign up. If you don’t have a bank account, you can get an Union Bank EON debit card or any debit card with a VISA logo.

Thankyou. Then, if i get that card the money from paypal can transfer? Then i can withdraw?

Yes Angela.

Hi

One of the requirement of freelancer is to have a Paypal account for the payment of services. Do you think EON debit card (UNION BANK) works for this? Please advice. Thanks in advance.

Hi Dina Tan, Yes EON debit card works perfectly with paypal so your paypal account will become verified and you can withdraw your fund from paypal or you can also purchase online using EON via paypal.

thanks. I will try to get EON from Unionbank..

Hi Manny,

Thank you for helping me know where and how to apply paypal account. MORE POWER AND GOD BLESS YOU.

how can i put funds in my paypal account? i just need to pay online.any advice.

Hi April,

Your problem can be solved by availing a debit card like Union Bank EON or RCBC My Wallet.

The easiest way to verify your paypal account without a credit or debit card is to simply use the PayMaya app of Smart Communications, Inc. It’s straightforward and it’s free. Just follow these easy steps here https://pinoythings.wordpress.com

If I cannot get my own card to verify my account. Do you feel using a bcc from Auction Essistance would solve my problem?

Hi! Can I use my BPI express teller savings debit card?

Hi Kyrasooo, I’m not sure but maybe you can try to link it with paypal. If it won’t link to paypal, you cannot use it.

hi manny,

hi manny, please mention how to have a paypal account.?

thanks

Hi, just sign-up in paypal to have a paypal account.

Hi Manny! Just want to ask for your

advice about applying for a Payoneer debit card instead of the debit cards that our local banks offer. I’m about to receive my Payoneer card and I’m wondrin’ if it will be better to apply for a local debit card instead. Thanks Much!

Hi ElleMentry,

I think payoneer is much like paypal than a bank that supplies debit cards. It depends on where are you going to use Payoneer. I think most companies that hire freelancers prefer to pay via payoneer than paypal. If you are going to get a local debit card, you still have to sign up on paypal or payoneer. Good for you that you already have a debit card from payoneer. Besides, paypal is commonly used by online sellers.

Hi, Manny

Need Help, ASAP, I’m paying through Paypal, for a membership for online surveys, is this true?,please advise!

Thanks!

Hi Bessie,

I doubt that paying for a fee to get an online survey job is legitimate. But maybe some who ask for a fee can give you a online survey job but you might be disappointed because the return is not what you might expect. Just use common sense. There are many online survey job for free, just search for it.

hi, just want to ask if i can use my BPI Express Express Savers account for paypal? Thanks 🙂

Hi ella,

As long as it is a saving account you can use it. But you can only withdraw money from paypal. Debit card works like a credit card where you can purchase and withdraw money from paypal.

Hi, I have a BPI express savers account. This account is also tied up with my paypal account, unfortunately, I am still unverified with paypal. I do not have a credit card account as well. What am I going to do? I can’t move on and work home-based if I am still unverified. HELP!

Hi Harvey,

You need to look into your statement of account either in online banking or ask for a printed copy of the said statement of account. You will find there a code that you will put into your paypal verification box and submit it. When did you add your BPI bank account in paypal?

hi i wanna ask if eon cyber bank account has cvv or cw? thank you

@jeb

yes

Hi,

Your blog is helpful. Thanks for sharing, I applied and used EON from Unionbank and successfully transferred funds from bank account. However, the BPI myePreapid doesn’t work for fund transfer. It is useful for the buyers but not really for sellers that would like to withdraw their money.

@Mariecar

Thanks for sharing about the BPI my ePrepaid. I think it is limited and won’t work on paypal. A saving account will work on selected banks which also include BPI. So far Unionbank EON is the only debit card I know compatible to paypal.

Hello Manuel

This is great!

I am constantly receiving your emails for years now and it is really helpful. This article is very very informative.

Thank you and more power!

Jerry

@Jerry Cruz

Thanks for your comment and a frequent reader of my post. And hoping I can create more quality articles in the future.

sir paano po makapag transact gaya ng online shopping using dollar money sa paypal without using debit/credit card.? guto ko sanang mag open ng account sa paypal for online shopping pero hindi ko pa alam lahat2x kasi.

@Bible, sorry debit card at credit card lang pwede gamitin para makapag online shopping.